what is a provisional tax code

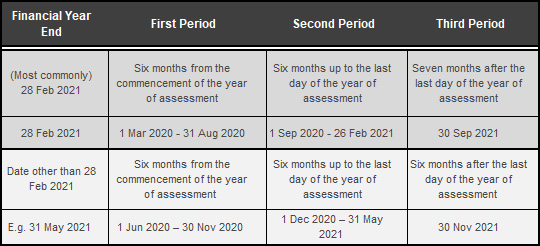

The first provisional tax return must be submitted within. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer.

It is income tax paid in advance during the year because of the way you your company or your trust.

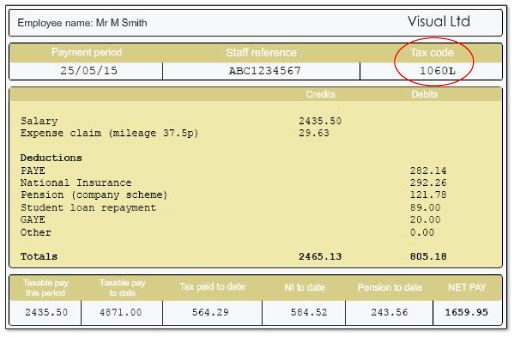

. Provisional tax is paid by individuals who earn income other than a salary traditional remuneration paid by an employer. When you amend a tax code and the new tax code exceeds 7 characters including prefixes and suffixes but no more than 5 numerical digits you should issue the P2 as normal using the. There are some situations where you may need to pay provisional tax on your reportable income.

Provisional taxpayers are people who earn income other. Self Employed people rental property. You need to work out your tax code for each source of income you receive.

Use our simple calculator to work out how big your tax refund will be when you submit your. Provisional tax payments can be made up of. Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives.

Amounts that you must pay under the provisional tax rules Amounts you choose to pay as voluntary payments to mitigate interest any. Natural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives. These can be due to.

Everyone pays income tax if they earn income. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of. Any person who receives an income other than a salary is a provisional taxpayer.

Provisional tax is not a separate tax. Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year. Provisional tax allows the tax liability to be.

What is provisional tax. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax debt on assessment. Incorrect use of tax code or rate for PAYE interest or dividends lump.

What Is A Provisional Tax Code. What Is A Provisional Tax Code. Total tax paid first plus second provisional tax payments R 379 811 Use our handy income tax calculator to work out your tax obligation Calculation of penalty R 412 611 - R.

A natural person who derives income other than remuneration or an. Tax codes help your employer or payer work out how much tax to deduct from your pay benefit or pension. Provisional tax is not a separate tax.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous. Provisional tax options There are 4 options available for working out your provisional tax. GST and provisional tax payments for Goods and services tax GST and provisional tax return - GST103 filers.

V The provisional tax payments together with any PAYE. Provisional tax is income tax you pay in instalments during the year. What is Provisional Tax.

For intermediaries payroll providers paying employee deductions. A provisional taxpayer is.

2021 Bond Election City Of Lewisville Tx

The Tax Impact Of The Long Term Capital Gains Bump Zone

Digital Tax Rules In Operation Across The Globe Vertex Inc

Managing My Money For Young Adults Session 2 5 Openlearn Open University

13 States That Tax Social Security Benefits Tax Foundation

Corporate Income Tax And Provisional Tax Obligations For Small Businesses Youtube

What Is A Provisional Taxpayer Tax 101 Youtube

Free Video Provisional Tax Part 1 Youtube

The Complete Guide To The Uk Tax System Expatica

Taxation In South Africa Wikipedia

Provisional Income Tax Due 26 February Do S And Don Ts For Companies

What Is A Provisional Taxpayer Tax 101 Youtube

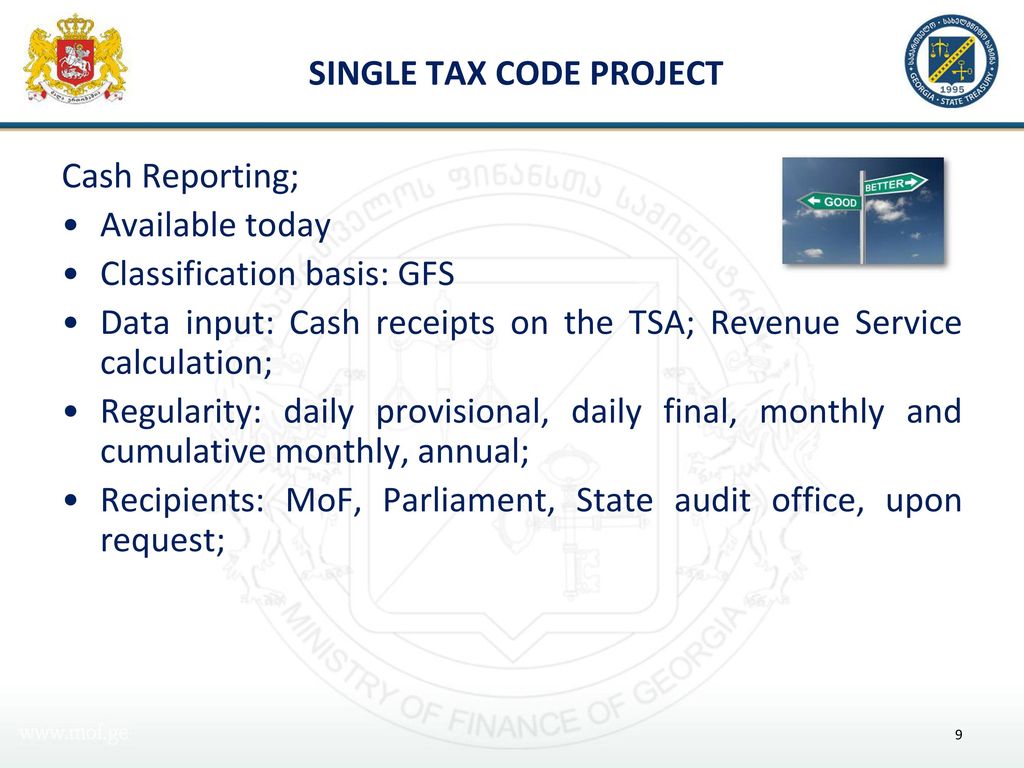

Single Tax Code Project Ppt Download

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)